Is the Euro Dead?

The unsavory Euro project started with the Stability Pact in the 1992 Maastricht Treaty. The Euro was introduced the first of January 2002; almost twenty years later, it is time to end the experiment and say goodbye to the Euro.

The idea was as crazy as to have the idea to implement the whole of America to use the USD and connect the economy of the USA with economies like Venezuela and Argentina. Europe is much smaller, but the differences in economies between countries as the Netherlands and Germany or Italy and Greece are comparable to the differences between the economies of the USA and South-American. From the admission of Greece and Italy into the Eurozone, the history of the Euro and the ECB has been one of persistent rule-breaking and cover-ups. Since 2008 and the Lehman crises, nothing has fundamentally changed. All the Quantitative Easing has lead to nothing. This is a path to nowhere, but even a path to nowhere is difficult to leave for politicians and policymakers. So now there is the perfect scapegoat, COVID, and all our economic misfortune can be blamed on COVID. But remember, all the financial problems we are facing now and will be facing in the near future were already there, even before COVID, so don´t let them fool you…

You Can Print Money, But You Cannot Print Goods

The Euro is very cheap. There is a negative interest for banks (imagine that you take a loan, and on top of that, the bank also pays you), and the Euro printer is working overtime. The ECB has enforced negative interest rates since June 2014, up to a rate of -0.5%. The idea was that negative rates would boost credit demand for investment and consumption, provide fiscal space for governments and thus increase aggregate demand. It didn’t turn out like that. What did happen was that it has boosted government debts, which in the Eurozone at the end of 2020 had risen to 98% of GDP overall for Eurozone members. How could this go wrong? It goes wrong if production doesn´t keep up. The Eurozone nominal GDP is now even lower than it was before the Lehman crisis. (Macleod, 2021)

Since 2008, the EU has been going from one crisis into the other. There was a series of crises involving Greece, Cyprus, Italy, Portugal, and Spain. The solutions to these problems were, in general, politically motivated to do whatever it takes to save the Euro. For example, the Greek crisis probably would have been solved better if the Greeks had left the EU. This would have been better for the EU in total, and it would have been better for the Greeks. However, one of the problems was that the most significant part of the Greek debt was to German banks, German banks would fail and it would have cost Germany a lot of money, if Greek would have left the EU. So what essentially happened is that the German banks were saved with the European taxpayers’ money, not the Greeks.

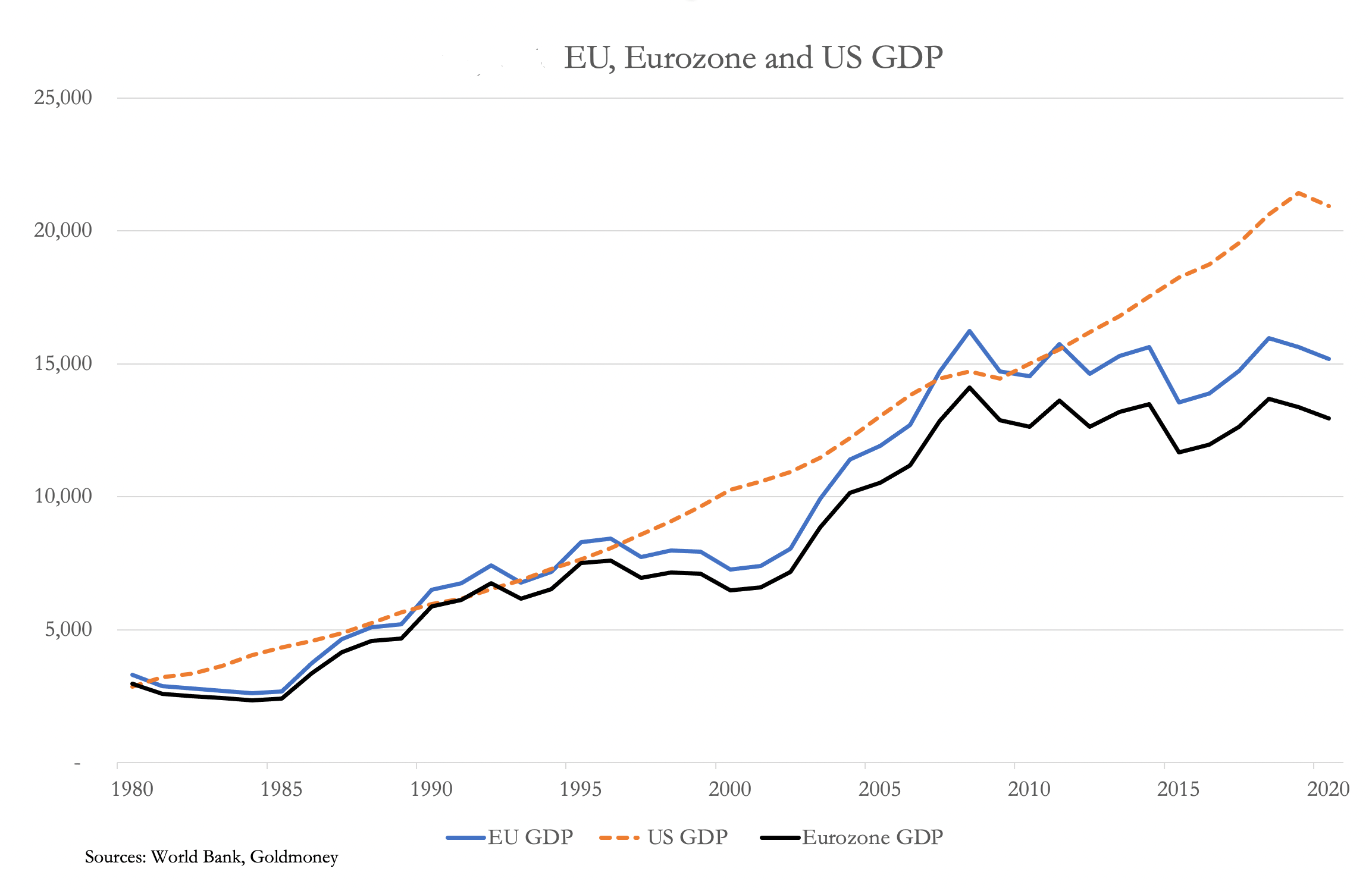

Furthermore, since 1994 the gap between Eurozone and non-Eurozone member nations GDP growth has increased from 9% to 15%, even adjusted for new memberships. It tells us that despite all the ECB’s money-printing, non-Eurozone members facing the same regulations and trading restrictions using their own currencies have outperformed the Eurozone. (Macleod, 2021) The idea of the Euro was to make economies more resistant and more robust, but it looks like the opposite has happened, even considering that Germany is part of the Eurozone.

If Money Doesn´t Work, Just Print More Money

The reason for the Eurozone’s underperforming GDP relative to that of the US is not hard to discern. The chart below shows how bank lending to the non-financial sector has broadly stalled since the Lehman crisis.

Instead, monetary growth has been in the ECB and the national central banks. From €2 trillion at the end of 2008, total Eurosystem balances grew to €7 trillion at end-2020. (Macleod, 2021)

The money supply increased significantly in 2020, as shown in the figure below, mainly due to the expansion of central bank balances in the Eurozone.

It is hard to outperform countries like Spain, France, and Italy concerning budget deficits, but the Euro area managed to do so very convincingly.

Government deficits in the Eurozone are persisting into the current year, expected by the ECB itself to rise to 8.7% of 2021 GDP. That’s on an estimated GDP of €13.476 trillion, giving a public sector deficit of €1.2 trillion, taking the debt to GDP figure to 103% for 2021. But this increase is mainly on the back of planned infrastructure spending and assumes a sharp recovery in tax revenues on the back of improving employment and higher consumer spending. Events have already overtaken that and fiscal deficits will be far higher than forecast. (Macleod, 2021)

Additionally, under the presidency of Christine Lagarde, the ECB is meddling in non-monetary affairs, giving precedence to a green agenda over fossil fuels, and creating precedents for the politicization of monetary affairs.

Hyperinflation

Officially, US prices are rising at 5.4%, while in the Eurozone, they are at the goal-sought target of 2%. We know that in the US, independent analysis confirms the actual rate of rising prices is over 13%, so by using similar CPI methodology, the Eurozone’s statisticians are misrepresenting the actual effect of rapidly increasing monetary inflation. There is hyperinflation, but because we measure inflation not adequately, the numbers don´t show it. For example, prices for houses went up 20% in the Netherlands, but this is not reflected in inflation numbers. The hyperinflation we see is not going to be transient.

Debt Covers Debt

The policy of continual monetary stimulation has run out of time. Policymakers were incompetent and did not use the time to fundamentally change the system after 2008. Now they created a crisis, they face the growing certainty of rising interest rates, falling financial asset values, and a slump accompanied by soaring prices. Not only is the starting point negative interest rates, but so is an average level of government debt to GDP of 103%. Averages conceal extremes, and with Greece’s debt to GDP officially at 217%, Italy at 151%, and Portugal at 137%, a combination of an economic downturn and soaring prices will destroy their difficult finances. Under `Whatever it takes,´ Mario Draghi and the ECB used every trick to cover over the cracks of a failing Eurozone and this prevented major banks from failing.

The Balance Of The Eurosystem

Germany and Luxembourg are owed a net €1.4 trillion. Italy and Spain owe the system €1,024 billion. And the ECB owes the national central banks €353 billion. The effect of the ECB deficit, which arises from bond purchases conducted on its behalf by the national central banks, is to artificially reduce the TARGET2 balances of debtors in the system to the extent the ECB has bought bonds from government and other issuers within an NCB’s jurisdiction and not yet paid for them. (Macleod, 2021) National central banks, which are heavily exposed to potentially bad loans in their domestic economy, know that their losses if materialized in a general banking crisis, will end up being shared throughout the central bank system.

Why is this a problem? If the national banking regulator considers loans to be non-performing, the losses will become a national problem. Alternatively, if the regulator deems them to be performing, they are eligible for the national central bank’s refinancing operations. A commercial bank can then use the questionable loans as collateral, borrowing from the national central bank, which spreads the loan risk with all the other central banks according to their capital keys. Insolvent loans are thereby removed from the PIGS’ (Portugal, Italy, Spain, Greece) national banking systems and dumped onto the Eurosystem.

In Italy’s case, the very high level of non-performing loans (NPL) peaked at 17.1% in September 2015 but had been reduced to 5.3% by March this year. The facts on the ground state that this cannot be true. Given the incentives for the Italian regulator to deflect the non-performing loan problem from the domestic economy into the Eurosystem, it would be a miracle if any of the reduction in NPLs is genuine. And with all the covid-19 lockdowns, Italian NPLs will have soared again, explaining perhaps why the Italian central bank’s TARGET2 liabilities have increased by €137 billion (!) over the course of COVID lockdowns. (Macleod, 2021)

With the banking regulator motivated to remove the problem from the domestic economy, loans to insolvent companies have been continually rolled over and increased. The consequence is that new businesses have been starved of bank credit because bank credit in the member nation’s banks is tied up with supporting the government and zombie businesses that should have gone bankrupt long ago.

TARGET2 Going Down

Officially there is no problem; the ECB and all the national central bank TARGET2 positions net out to zero. But, because some national central banks end up using TARGET2 as a source of funding for their own balance sheets, which in turn fund their risky commercial banks using their non-performing loans as collateral, some national central banks have mounting potential liabilities.

Germany’s Bundesbank is the Eurosystem member with the greatest burden, now lending well over a trillion euros through TARGET2 to central banks exploiting the system. The risk of losses for the TARGET2 lenders is now accelerating rapidly because of COVID lockdowns, as seen in the chart of TARGET2 imbalances above. The Bundesbank should be very concerned. The ECB’s balance sheet subscribed capital is only €7.66 billion, which is minuscule compared with the losses involved. A TARGET2 failure would appear to require the ECB to effectively expand its QE programs to recapitalize itself and the whole eurozone central banking system.

Stock Market Up, But Not For The Banks

Since the financial crisis in 2008, the S&P500 index was in a continual bull market until COVID came. At the same time, the share prices of European banks as represented in the ETF were in a bear market. Given the strong performance of equity markets, the abysmal performance of the banks’ shares is ominous. It is a contradictory message suggesting businesses may survive and prosper, but banks might not.

Another factor is that an investor picking up Eurozone bank shares knows the ECB and the national banks effectively underwrite them. They would be certain to come to their rescue in the event of a systemic crisis. Yet with this implied guarantee, shares in Société Generale and Deutsche Bank are trading at these lows.

Leverage, More Leverage, Over-Leveraged

The concealment of bad debts in TARGET2 has undoubtedly saved the Eurozone’s commercial banks from going under because they are very highly geared to losses, as the table illustrates.

The balance sheet gearing, that is the ratio of balance sheet assets to balance sheet equity, are all exceptionally high, with the French bank, Credit Agricole, being over 30 times. Compare this with American G-SIBs, which are geared an average of about 11 times. And while the US G-SIBs have a price to book ratio averaging about 1.3 times, none of the Eurozone G-SIBs have a price to book of over one. (Macleod, 2021)

Banks such as Société Generale and Deutsche having an implied leverage for shareholders of over 60 times. It makes sense to look through these numbers and conclude that the Eurosystem’s ability to rescue these banks from collapse may be limited so far as the markets are concerned. A rescue of failing G-SIBs is a near certainty, but the terms are not. Furthermore, the threat of bail-ins, which are now widely incorporated in G-20 legislation, would leave existing shareholders heavily diluted.

Conclusion

When Germany’s Bundesbank finds that instead of being owed some €1.1 trillion by the other national central banks, she is on the hook for €400 billion it will be the last straw for people whose savings will have been wiped out. The same can be said for Finland, Luxembourg, the Netherlands, and some of the smaller states. The financial position of highly indebted Eurozone members will become rapidly untenable, and the very existence of the Euro, the glue that holds it all together, will be threatened. Attempts to replace the Euro with a new euro and central banking network will face significant hurdles. All we know is that the rottenness of the euro area monetary system will almost certainly lead to its destruction and, most likely, the end of the Euro itself.

Interesting links:

There Is No Financial Bubble, Hyperinflation Is Already Here

Universal Basic Income, How to Sleepwalk Yourself Into Serfdom. Part I: Robotics Will NOT Make Us Jobless

Universal Basic Income, How To Sleepwalk Yourself Into Serfdom. Part II: Government: The Hand That Feeds and Takes

Universal Basic Income, How To Sleepwalk Yourself Into Serfdom. Part III: Digital Currencies, Total Control

The Trap of Digital Currencies and How Bitcoin Can Save You

4 Things You Should Know About the New European Green Deal: It’s a Hard Rain’s a-Going to Fall

Reference

Macleod, A. (2021, August 21). Eurozone finances have detoriated. Retrieved from Goldmoney: https://www.goldmoney.com/research/goldmoney-insights/eurozone-finances-have-deteriorated

You think this is a worthy blog and you want to read more?